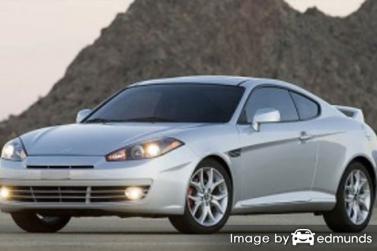

Do you need a better way to compare more affordable Hyundai Tiburon insurance in Chicago? I can’t think of a single person who enjoys paying for car insurance, especially knowing they could get a better deal.

Do you need a better way to compare more affordable Hyundai Tiburon insurance in Chicago? I can’t think of a single person who enjoys paying for car insurance, especially knowing they could get a better deal.

Astonishng but true according to a recent study, 70% of consumers have purchased from the same company for a minimum of four years, and virtually 40% of consumers have never even shopped around for cheaper coverage. With the average car insurance premium being $1,500, Chicago drivers could pocket about 40% a year by just comparing quotes, but they don’t understand how simple it is to compare other rate quotes.

Companies like State Farm, Allstate, GEICO and Progressive continually hit you with catchy ads and consumers find it hard to see past the corporate glitz and effectively compare rates to find the best deal.

It is always a good idea to compare prices periodically because car insurance prices are variable and change quite frequently. Even if you got the best deal on Hyundai Tiburon insurance in Chicago on your last policy there may be better deals available now. Forget anything you know (or think you know) about car insurance because you’re going to learn the proper way to remove unneeded coverages and save money.

If you are already insured, you should be able to shop for the lowest rates using the concepts you’re about to learn. Locating the best rates in Chicago is quite easy if you know the best way to do it. But Illinois vehicle owners can benefit by having an understanding of the way companies sell insurance online because it varies considerably.

Buy Chicago Hyundai Tiburon insurance online

It’s important to know that comparing more rates from different companies provides better odds of finding a lower rate. Some insurance companies are not set up to provide price estimates online, so you need to compare rates on coverage from those companies, too.

The providers in the list below provide free quotes in Chicago, IL. If multiple providers are shown, we suggest you visit several of them to find the lowest auto insurance rates.

Do you qualify for discounts on Hyundai Tiburon insurance in Chicago?

Companies that sell car insurance don’t necessarily list their entire list of discounts very clearly, so below is a list some of the best known and the more hidden discounts that you may qualify for.

- Onboard Data Collection – Insureds that choose to allow data collection to monitor driving manner by installing a telematics device like Allstate’s Drivewise could possibly reduce rates as long as they are good drivers.

- Professional Organizations – Belonging to qualifying employment or professional organizations could trigger savings on your bill.

- Life Insurance Discount – Larger insurance companies have a small discount if you purchase auto and life insurance together.

- Good Drivers – Accident-free drivers can save as much as half off their rates than drivers with accidents.

- Driver Safety – Completing a course that instructs on driving safety could cut 5% off your bill and make you a better driver.

- Accident Free – Claim-free drivers are rewarded with significantly better rates on Chicago auto insurance quote in comparison to accident-prone drivers.

Just know that most of the big mark downs will not be given to the overall cost of the policy. Most only cut specific coverage prices like comp or med pay. Just because it seems like adding up those discounts means a free policy, you’re out of luck.

A few companies that have these money-saving discounts include:

If you need low cost Chicago auto insurance quotes, ask each insurance company which discounts can lower your rates. Discounts may not be offered in your state. If you would like to choose from a list of providers with the best Hyundai Tiburon insurance discounts in Chicago, click this link.

Insurance agent or online?

A small number of people still prefer to buy from a licensed agent and that can be a smart move One of the benefits of comparing rates online is the fact that drivers can get the best rates and still choose a local agent. Supporting small agencies is especially important in Chicago.

After completing this quick form, your insurance coverage information is emailed to participating agents in Chicago who will give you quotes and help you find cheaper coverage. There is no reason to do any legwork as quotes are delivered to the email address you provide. Get lower rates and work with a local agent. If for some reason you want to get a comparison quote from a particular provider, you just need to find their quoting web page and give them your coverage information.

When searching for an insurance agent, there are a couple of types of insurance agents to choose from. Auto insurance agents in Chicago are categorized either independent or exclusive depending on the company they work for.

Independent Auto Insurance Agents

Agents in the independent channel often have many company appointments and that gives them the ability to insure with multiple insurance companies and find the cheapest rate. To transfer your coverage to a different company, the agent simply finds a different carrier which requires no work on your part. If you need cheaper auto insurance rates, it’s recommended you include multiple independent agents to have the most options to choose from.

The following is a short list of independent insurance agents in Chicago who may provide free rate quotes.

Illinois Vehicle Auto Insurance (Xpert)

1858 W 18th St – Chicago, IL 60608 – (312) 226-1033 – View Map

Active Insurance Agency – Auto Insurance

1034 N Ashland Ave – Chicago, IL 60622 – (773) 286-3473 – View Map

American Auto Insurance

3201 N Harlem Ave #1 – Chicago, IL 60634 – (773) 286-3500 – View Map

Exclusive Agencies

Exclusive agencies can only provide one company’s prices such as AAA, Allstate, and State Farm. Exclusive agents cannot provide prices from multiple companies so they really need to provide good service. Exclusive agents are highly trained on the products they sell which helps them compete with independent agents.

Listed below is a short list of exclusive agents in Chicago who can help you get comparison quotes.

Mike Matkowskyj – State Farm Insurance Agent

2452 W Chicago Ave – Chicago, IL 60622 – (773) 486-4444 – View Map

Judith Gleason – State Farm Insurance Agent

2643 N Harlem Ave – Chicago, IL 60707 – (773) 637-8547 – View Map

Allstate Insurance: Maribel Marron

3060 W Armitage Ave – Chicago, IL 60647 – (773) 572-9495 – View Map

Selecting an auto insurance agent should include more criteria than just a cheap price. Any good agent in Chicago should know the answers to these questions.

- Is the quote a firm price?

- What are the financial ratings for the companies they represent?

- Do you qualify for any additional discounts?

- Is assistance available after office hours?

- If they are an independent agency in Chicago, which companies do they recommend?

- How much will you save each year by using a higher deductible?

Eight Things That Impact Your Insurance Prices

Many things are used when you get your auto insurance bill. Some are obvious like a motor vehicle report, but other criteria are less obvious such as your marital status or how financially stable you are.

- Type of car determines base premiums – The performance of the car you need to insure makes a substantial difference in your auto insurance rates. Since the Hyundai Tiburon falls in the sports car class, insurance will be much more compared to average rates in Chicago. Smaller low performance passenger vehicles receive the most favorable rates, but there are many factors that impact the final cost.

- Better prices for continuous coverage – Going without insurance is a quick way to drive up your policy premiums. Not only will you pay more, being ticketed for driving with no insurance could result in fines and jail time.

- Does car insurance cost less for women? – Statistics show women tend to be less risk to insure than men. However, don’t assume that women are BETTER drivers than men. Females and males are responsible for auto accidents in similar numbers, but the men get into accidents with more damage. Not only are claims higher, but men receive more costly citations such as DWI and reckless driving. Male drivers age 16 to 19 are most likely to cause an accident so it costs more to insure them.

- Car insurance rates and your employer – Careers such as lawyers, airline pilots, and medical professionals generally pay higher premium rates because of intense work-related stress and extremely grueling work hours. On the other hand, occupations like farmers, engineers and retirees generally pay rates lower than average.

- Avoid unnecessary extra coverages – There are a lot of optional add-on coverages that can waste your money if you aren’t careful. Add-on coverages like roadside assistance, accident forgiveness, and membership fees are probably not needed. They may seem like a good idea when you first buy your policy, but if you have no use for them think about removing them and cutting costs.

- Why do you need liability insurance? – Liability coverage will afford coverage in the event that a court rules you are at fault for physical damage or personal injury to other. It will provide legal defense which can be incredibly expensive. Liability insurance is pretty cheap compared to physical damage coverage, so insureds should have plenty of protection for their assets.

- Obey driving laws and save – Your driving record impacts your car insurance rates tremendously. Attentive drivers have lower premiums compared to drivers with tickets. Even one speeding ticket can boost insurance rates twenty percent or more. Drivers who get severe violations like reckless driving, hit and run or driving under the influence may face state-mandated requirements to file a SR-22 with their state’s licensing department in order to keep their license.

- Single drivers may get higher premiums – Having a wife or husband may save some money when shopping for car insurance. Having a spouse usually means you are more mature and responsible and it’s proven that married drivers tend to file fewer claims.

Auto insurance does more than just protect your car

Despite the high insurance cost for a Hyundai Tiburon in Chicago, paying for auto insurance is not optional due to several reasons.

First, the majority of states have mandatory insurance requirements which means state laws require a specific level of liability coverage in order to be legal. In Illinois these limits are 20/40/15 which means you must have $20,000 of bodily injury coverage per person, $40,000 of bodily injury coverage per accident, and $15,000 of property damage coverage.

Second, if you have a lien on your car, most lenders will stipulate that you have physical damage coverage to ensure they get paid if you total the vehicle. If you cancel or allow the policy to lapse, the bank or lender will purchase a policy for your Hyundai at a much higher rate and require you to fork over for it.

Third, auto insurance protects not only your vehicle but also your financial assets. It will also provide coverage for all forms of medical expenses for you, any passengers, and anyone injured in an accident. One policy coverage, liability insurance, will also pay for a defense attorney if you cause an accident and are sued. If damage is caused by hail or an accident, comprehensive (other-than-collision) and collision coverage will pay all costs to repair after the deductible has been paid.

The benefits of having insurance greatly outweigh the cost, especially when you need to use it. But the average American driver is overpaying more than $810 a year so it’s very important to do a rate comparison each time the policy renews to help ensure money is not being wasted.

Don’t give up on cheaper premiums

Budget-conscious Hyundai Tiburon insurance is definitely available both online in addition to many Chicago insurance agents, so you need to shop Chicago auto insurance with both so you have a total pricing picture. Some insurance companies do not offer online rate quotes and usually these regional insurance providers only sell through independent agents.

As you quote Chicago auto insurance, do not buy poor coverage just to save money. In too many instances, someone dropped uninsured motorist or liability limits only to regret that the small savings ended up costing them much more. The aim is to get the best coverage possible at the best possible price while not skimping on critical coverages.

For more information, feel free to browse these articles:

- Teen Driver Statistics (Insurance Information Institute)

- Who Has Cheap Car Insurance Rates for Low Income Drivers in Chicago? (FAQ)

- Who Has Cheap Car Insurance for Uber Drivers in Chicago? (FAQ)

- What Car Insurance is Cheapest for a Jeep Wrangler in Chicago? (FAQ)

- Your Car has been Stolen: Now What? (Allstate)

- Property Damage Coverage (Liberty Mutual)

- Alcohol Impaired Driving FAQ (iihs.org)