Did a good deal turn into an expensive insurance policy? It’s quite common and there are lots of people in the same boat.

Unbelievable but true according to a study the vast majority of consumers have remained with the same insurance company for more than four years, and almost 40% of drivers have never shopped around. With the average insurance premium being $1,500, Chicago drivers can save hundreds of dollars each year by just comparing quotes, but they don’t believe how much money they would save if they switched.

Unbelievable but true according to a study the vast majority of consumers have remained with the same insurance company for more than four years, and almost 40% of drivers have never shopped around. With the average insurance premium being $1,500, Chicago drivers can save hundreds of dollars each year by just comparing quotes, but they don’t believe how much money they would save if they switched.

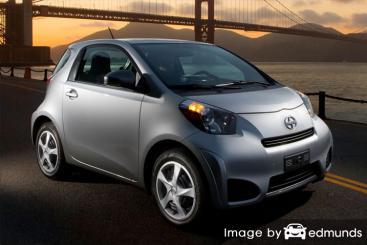

There are many car insurance companies to pick from, and even though it’s nice to have a selection, it makes it harder to get the best deal for Scion iQ insurance in Chicago.

You need to get comparison quotes yearly since prices go up and down regularly. If you had the best rate on Scion iQ insurance in Chicago on your last policy other companies may now be cheaper. You’ll find a ton of advice on iQ insurance online, but you can learn some solid techniques on how to save money.

This article’s goal is to let you in on how to compare rates easily. If you have insurance now, you will definitely be able to reduce the price you pay using the concepts you’re about to learn. Although Illinois vehicle owners must understand the way companies market insurance on the web and use it to find better rates.

Cheap Scion insurance price quotes in Chicago

The providers in the list below can provide price quotes in Illinois. If multiple companies are listed, it’s a good idea that you get price quotes from several of them to get the best price comparison.

Affordable rates with discounts

Not too many consumers would say insurance is affordable, but there may be some discounts that can help lower your rates. Certain reductions will be credited when you complete an application, but once in a while a discount must be inquired about before being credited.

- Passive Restraints – Factory air bags or automatic seat belts can get savings of more than 20%.

- Theft Deterrent – Vehicles that have factory alarm systems and tracking devices help deter theft and qualify for as much as a 10% discount.

- Fewer Miles Equal More Savings – Fewer annual miles on your Scion could earn substantially lower insurance rates.

- Auto/Life Discount – If the company offers life insurance, you could get a discount if you purchase some life insurance in addition to your auto policy.

- Safe Driver Discount – Drivers who don’t get into accidents could pay up to 40% less than less cautious drivers.

- Savings for New Vehicles – Insuring a new iQ is cheaper because newer models keep occupants safer.

- Policy Bundle Discount – When you have multiple policies with the same insurance company you may save at least 10 to 15 percent or more.

It’s important to understand that most discounts do not apply to the entire policy premium. A few only apply to the price of certain insurance coverages like collision or personal injury protection. So even though they make it sound like all the discounts add up to a free policy, companies don’t profit that way.

Popular insurance companies and some of the discounts are included below.

- State Farm offers discounts including Drive Safe & Save, driver’s education, safe vehicle, multiple policy, and accident-free.

- Progressive policyholders can earn discounts including multi-vehicle, good student, online signing, online quote discount, continuous coverage, homeowner, and multi-policy.

- Progressive discounts include online quote discount, multi-policy, homeowner, good student, online signing, and continuous coverage.

- MetLife offers discounts for good student, good driver, claim-free, multi-policy, accident-free, defensive driver

- Farm Bureau has discounts for safe driver, driver training, youthful driver, 55 and retired, and good student.

- GEICO has savings for good student, anti-theft, military active duty, membership and employees, multi-vehicle, and air bags.

- SAFECO may include discounts for accident prevention training, bundle discounts, anti-theft, homeowner, and teen safety rewards.

When getting a coverage quote, ask each company how you can save money. Some discounts listed above may not be available in your area. To locate insurers with discount rates in Chicago, click this link.

There’s no such thing as the perfect insurance policy

When it comes to buying adequate coverage for your vehicles, there really isn’t a cookie cutter policy. Everyone’s situation is a little different.

Here are some questions about coverages that could help you determine if your insurance needs could use an agent’s help.

- Am I getting all the discounts available?

- Am I covered when using my vehicle for business?

- Do I need replacement cost coverage on my Scion iQ?

- How can I get high-risk coverage after a DUI?

- Will my Scion iQ be repaired with OEM or aftermarket parts?

- Is my cargo covered for damage or theft?

If you can’t answer these questions but a few of them apply then you might want to talk to an agent. To find lower rates from a local agent, take a second and complete this form.

Shop online but buy locally

Some consumers would prefer to get advice from a local agent and often times that is recommended An additional benefit of getting free rate quotes online is that you can obtain cheaper car insurance rates and still have a local agent. And buying from local insurance agents is especially important in Chicago.

To help locate an agent, after submitting this short form, the coverage information is submitted to local insurance agents who will give you bids for your coverage. You don’t have to leave your house due to the fact that quote results will go to your email. You can find lower rates without having to waste a lot of time. If you want to quote rates from a specific company, don’t hesitate to jump over to their website and submit a quote form there.

If you are searching for a reliable insurance agency, it can be helpful to understand the different types of agents and how they work. Auto insurance agencies can either be independent or exclusive depending on the company they work for.

Independent Agents

These agents are normally appointed by many insurers and that gives them the ability to insure through lots of different companies and potentially find a lower price. To move your coverage to a new company, your agent can just switch to a different company and you won’t have to switch agencies.

If you are trying to find cheaper rates, it’s recommended you get quotes from several independent agencies so that you have a good selection of quotes to compare.

The following are Chicago independent agencies who may be able to give you price quotes.

Eagle Insurance Agency

3517 N Spaulding Ave – Chicago, IL 60618 – (773) 463-7576 – View Map

Riehn Insurance

4541 N Lincoln Ave – Chicago, IL 60625 – (773) 561-4200 – View Map

Amigo Insurance Agency

5902 W Fullerton Ave – Chicago, IL 60639 – (877) 999-2644 – View Map

Exclusive Agents

Exclusive agencies work for only one company such as State Farm, Allstate and AAA. Exclusive agents cannot compare rates from other companies so they have no alternatives for high prices. Exclusive agents are very knowledgeable on the products they sell which can be an advantage.

Shown below is a list of exclusive insurance agencies in Chicago willing to provide price quotes.

Kathleen McKenzie – State Farm Insurance Agent

725 W 31st St – Chicago, IL 60616 – (312) 791-1200 – View Map

Jim Tom – State Farm Insurance Agent

4317 N Lincoln Ave – Chicago, IL 60618 – (773) 477-3300 – View Map

Sylvia Torres Underhill – State Farm Insurance Agent

2422 S Oakley Ave – Chicago, IL 60608 – (773) 376-1166 – View Map

Finding the right insurance agency requires you to look at more than just a cheap price quote. Any good agent in Chicago should know the answers to these questions.

- Will the company cover a rental car if your car is getting fixed?

- Do they review policy coverages at every renewal?

- Are aftermarket or OEM parts used to repair vehicles?

- Does the company have a local claim office in Chicago?

- What is the financial rating for the quoted company?

Quote more to save more

As you go through the steps to switch your coverage, it’s a bad idea to buy lower coverage limits just to save a few bucks. In many instances, an insured dropped full coverage only to regret that it was a big error on their part. Your goal should be to purchase plenty of coverage for the lowest price, but do not skimp to save money.

Drivers who switch companies do it for a number of reasons such as high prices, lack of trust in their agent, being labeled a high risk driver or denial of a claim. Whatever your reason, finding the right auto insurance provider can be less work than you think.

Low-cost Scion iQ insurance in Chicago can be purchased both online and from local insurance agents, so you should compare both to get a complete price analysis. Some companies may not offer online quoting and many times these regional carriers only sell coverage through independent agencies.

Additional information

- Uninsured Motorists: Threats on the Road (Insurance Information Institute)

- Who Has Affordable Auto Insurance for Real Estate Agents in Chicago? (FAQ)

- What Car Insurance is Cheapest for a School Permit in Chicago? (FAQ)

- Rental Reimbursement Coverage (Allstate)

- Prom Night Tips for Teen Drivers (State Farm)

- How to Avoid Common Accidents (State Farm)